Have Resolution Plans Rescued Insolvency?

Introduction

Globally India’s Ranking in Ease of Doing Business is at 63rd Position in 2020 from being at 130th in the year 2016. One of the parameters for evaluating Ease of Doing Business is resolving insolvency. Against this parameter, India stands at 52nd from the 136th Position (out of 190 Countries) in the year 2016. In last 4 years, India is showing a notable improvement in Ease of Doing Business among other countries and soon it is expected to hit in the list of top 50 countries. While the parameters of the Global Ranking could be debated upon, it is critical to examine if ease of exit of business through resolving insolvency has improved in the country.

Reforms in Insolvency Resolution in India through introduction of Insolvency and Bankruptcy Code, 2016 (IBC, 2016) has created a notable framework by laying a platform for revival through resolution in a time bound manner, promoting entrepreneurship by reviving a going concern, balancing the interest of stakeholders, boosting credit availability and ease of recovery in the country with tight regulatory framework.

The Insolvency and Bankruptcy Code, 2016 (“the Code”) aims to resolve the trouble of the stressed Corporate Debtors by moving them into a Corporate Insolvency Resolution Process (CIRP) and transferring them as going concern to persons/entities termed as Resolution Applicants who will be willing to take over their management & assets by way of submitting a Resolution Plan. The Resolution Amount will be utilized to settle the liabilities of the Corporate Debtor. The key element of the code is cutting down the time involved in resolving insolvency to Maximum of 330 days.

Look Back on cases under the IBC

Since the inception of provisions relating to CIRP, a total of 4,139 CIRP have commenced till end of December 2020. Out of these cases, 979 have been closed on appeal, review, settled and withdrawn, 1126 have been ordered for liquidation and 317 have been revived in approval of Resolution Plans and the balance 1717 cases are still in CIRP Process.

- Year wise Distribution of CIRP’s as on 31st December 2020.

| Year | CIRP at Beginning (A) | Admitted (B) | Closed (C) | Ongoing CIRP

(A + B – C) |

| 2016 – 17 | – | 37 | 1 | 36 |

| 2017 – 18 | 36 | 706 | 204 | 538 |

| 2018 – 19 | 538 | 1,152 | 630 | 1,060 |

| 2019 – 20 | 1060 | 1,961 | 1,193 | 1,828 |

| 2020 – 21

(Apr-Dec) |

1828 | 283 | 394 | 1717 |

| Total | – | 4,139 | 2,422 | 1,717 |

The 2,422 CIRP cases were closed by way of following: Appeal/Review/ Settled/ Withdrawn Appeal/Review/ Settled/ Withdrawn

| Year | 1. Appeal/Review/ Settled/ Withdrawn | 2. Approval of Resolution Plan | 3. Commencement of Liquidation | Total Closed | |||

| No. | % of Closed | No. | % of Closed | No. | % of Closed | ||

| 2016 – 17 | 1 | 100% | 0 | 0% | 0 | 0% | 1 |

| 2017 – 18 | 93 | 45% | 20 | 10% | 91 | 45% | 204 |

| 2018 – 19 | 245 | 39% | 80 | 13% | 305 | 48% | 630 |

| 2019 – 20 | 511 | 43% | 141 | 12% | 541 | 45% | 1,193 |

| 2020 – 21 (Apr-Dec) | 129 | 33% | 76 | 19% | 189 | 48% | 394 |

| %Total | 979 | 40% | 317 | 13% | 1,126 | 47% | 2,422 |

- Sector wise Distribution of CIRP’s as on 31st December 2020.

| S. No. | Sector | Admitted | Ongoing CIRP | Total Closed | Closure by | |||||

|---|---|---|---|---|---|---|---|---|---|---|

| Appeal/Review/ Settled/ Withdrawn | Approval of Resolution Plan | Commencement of Liquidation | ||||||||

| No. | % of Closed | No. | % of Closed | No. | % of Closed | |||||

| 1 | Manufacturing | 1,703 | 688 | 1,015 | 357 | 35% | 161 | 16% | 497 | 49% |

| 2 | Real Estate, Renting & Business Activities | 816 | 339 | 477 | 248 | 52% | 41 | 9% | 188 | 39% |

| 3 | Construction | 439 | 194 | 245 | 133 | 54% | 28 | 11% | 84 | 34% |

| 4 | Wholesale & Retail Trade | 408 | 167 | 241 | 87 | 36% | 17 | 7% | 137 | 57% |

| 5 | Hotels & Restaurants | 95 | 33 | 62 | 29 | 47% | 12 | 19% | 21 | 34% |

| 6 | Electricity & Others | 128 | 72 | 56 | 18 | 32% | 13 | 23% | 25 | 45% |

| 7 | Transport, Storage & Communications | 123 | 46 | 77 | 26 | 34% | 9 | 12% | 42 | 55% |

| 8 | Others | 427 | 178 | 249 | 81 | 33% | 36 | 14% | 132 | 53% |

| Total | 4,139 | 1,717 | 2,422 | 979 | 40% | 317 | 13% | 1,126 | 47% | |

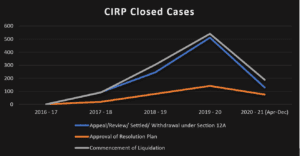

- Graphical Representation of CIRP Closed Cases.

Reference: The above data are obtained from Insolvency and Bankruptcy Board of India News Letter

While reviewing the year wise trend of cases, it will be observed that during the year 2018-19 & 2019-20 the number of cases admissions into CIRP has increased to 1.6 times & 1.7 times respectively reflecting an early acceptance of IBC as an effective debt resolution mechanism across the stakeholders. However, in subsequent year, due to the pandemic, the number of cases has been drastically reduced on account of suspension notification issued.

The sectoral analysis indicate manufacturing and real estate sectors are the hugely affected sectors and struggling in distress with over 61% of cases attributable to these sectors alone. It is observed that more of companies in wholesale and retail Sector have been resolved by way of Liquidation only.

On reviewing the progress towards the essence of IBC, being revival, it will be observed that only 317 cases out of 2,422 closed cases (i.e., 13%) have been revived by way of approval of Resolution Plan which is significantly lower figure when compared to liquidation which is 47%.

This number warrants a close analysis to examine if productive assets are potentially being liquidated given the fact that we cannot afford to destroy such assets. We are conscious of the fact that a good number of early cases represent the hard-core legacy sub-standard assets.

On other hand, in terms of realisation, it was observed that realisation value for creditors from the approved resolution plans in the 317 cases is Rs. 2.01 lakh crore, which is 39.37% of total admitted claims (i.e., Rs. 5.11 lakh crore) which is 181.70% of the liquidation value of these 317 cases (i.e., Rs. 1.11 Lakh crore). The realisation as a percentage of the claims, unfortunately, is also a reflection of the quality of the assets that had been funded by the system.

It is relevant to state at this juncture that RBI had directed 12 large corporate accounts for CIRP in the year 2017 when IBC was notified. It was estimated that out of the total bad loans of Indian banks, these 12 accounts accounted for 25% of the total exposure of the banking system. While we examine the outcome of the process today, banks have recovered 56% of their dues from 9 Corporate Debtor for which resolution plan has been approved.

| Name of CD | Claims of FCs Dealt Under Resolution (in Crores) | Realisation as a percentage of Liquidation Value | Successful Resolution Applicant |

||

| Amount Admitted | Amount Realised | Realisation as % of Claims | |||

| Completed | |||||

|

49,473 | 41,018 | 83% | 267% | Arcelor Mittal India Pvt. Ltd. |

|

56,022 | 35,571 | 63% | 253% | Bamnipal Steel Ltd. Subsidiary of Tata Steel |

|

47,158 | 19,350 | 41% | 209% | JSW Limited |

|

29,523 | 5,052 | 17% | 115% | Reliance Industries Limited, JM Financial Asset Reconstruction Company Ltd., JMFARC – March 2018 Trust |

|

23,176 | 23,223 | 100% | 131% | NBCC (India) Limited |

|

13,175 | 5,320 | 40% | 183% | Vedanta Ltd. |

|

12,641 | 2,615 | 21% | 170% | Deccan Value Investors L.P. and DVI PE (Mauritius) Ltd. |

|

11,015 | 2,892 | 26% | 123% | Consortium of JSW and AION Investments Pvt. Ltd. |

|

7,365 | 3,691 | 50% | 387% | Group of HNIs led by Mr. Sharad Sanghi. |

| Total | 2,49,548 | 1,38,732 | 56% | ||

| Under Process | |||||

|

Under CIRP | ||||

|

Under Liquidation | ||||

|

Under Liquidation | ||||

It is interesting to note that out of 12 cases, 9 cases have been revived through resolution plan while two is undergoing liquidation and another is still in CIRP. Though the lenders have taken a substantial haircut, the realisations were far higher than the liquidation value of the company. This not only assisted in recovery to the stakeholders which in turn boosting the credit availability but promoting the continuance of business and job opportunities across the organisations for the overall economic growth of the country.

It highlights the need of revival of the stressed organisations through Resolution plan where productive assets and business are available for acquisition through a transparent price discovery mechanism. Revival through Resolution Plan can be a win-win situation for all the stakeholders in terms of recovery, enabling the business to continue as a going concern, and Job continuance of employees.

Resolution Plan

Against this background, it is critical to examine the importance of the Resolution Plans in the context of Code. Resolution Plan means a plan proposed by resolution applicant for resolution of the Corporate Debtor as a going concern in accordance with IBC, 2016. It is an action plan for revival of Corporate Debtor undergoing insolvency and prevents value destruction of the company by going into liquidation.

More of Liquidation than Resolution

While the primary objective of the Code being revival, the existing data reflects that during last four years of IBC, 2016, majority of cases have ended up in liquidation rather than Resolution which goes against the grain of the Code. A study of this failure of revival through Resolution Plan highlights multiple factors which need to be focused and alternative to be placed.

Factors leading to Liquidation:

- The economic value in most of these Corporate Debtors had already eroded before they were admitted into CIRP.

- Lack of awareness to the potential interested applicants regarding acquisition opportunities of productive businesses through submission of Resolution Plans.

- Nature of underlying business and assets are not attracting the cluster of potential interested applicants.

- The lack of convergence of the recovery expectation of creditors and potential business value as determined by the Resolution Applicant.

- Resolution Plan offered at very low amount due to perceived deterioration in the value of the Corporate Debtor.

- Resolution Plan is not approved by CoC or Adjudicating Authority as it does not comply with relevant provisions of IBC or eligibility under Section 29A to submit the plan.

Areas to be addressed:

- Challenges faced by Resolution Applicants

Despite the Code aiming to preserve the value of the Corporate Debtor, the reality falls short of the expectations and what it should have ideally been.

The time taken for approval and implementation of the Resolution Plan makes the Resolution applicant exhausted in the process. The facts such as approval hierarchy structure of the financial institutions, applications filed by creditors post approval of Resolution Plan and statutory authorities approvals & abiding to the Resolution Plan puts the time bound process for a toss.

There are quite number of cases where even after approval of Resolution Plan the Resolution applicant faces challenges in implementing the plan by way of past statutory liabilities or claims of operational creditors which were not covered in Resolution Plan which are hindering the implementation of the Resolution plan. This requires a need to create awareness on statutory authorities and operational creditors on the CIRP such as filing of claim for prior period dues. A good part of these have been addressed by amendments to the Code or judicial pronouncements but given the nascent stage in which the Code is this is to be largely expected.

- Acquisition at rock bottom prices

In most of the cases the resolution plans of the Corporate Debtor have been for values that are lesser than its Liquidation value and Lenders could not recover fair amount of their outstanding dues. One of the potential reasons behind lower of Corporate Debtor is upon of Initiation of CIRP the value of the Corporate Debtor sharply deteriorates due to various factors such as change of management, loss of goodwill, poor creditors relationship and substandard performance. In the recent times it was observed that on account of this the Resolution plan provides proposals at rock bottom prices which is way lower than liquidation value of the Corporate Debtor. In certain cases, the focus on future economic benefit is weighted more than the intrinsic value of the Corporate Debtor. This extends the gap of realisation with recovery to Creditors with chasm getting wider.

- Flexibility on Resolution Plan

The present convention exists in the code is that the Resolution Plan is to be submitted for the entire business and operations under one plan. In reality, the prospective applicants will be interested in particular business units or assets against the entire businesses.

It indicates the need for amendment in the code to enable the prospective applicants to take over the separate business units or assets which in turn make multiple applicants to submit multiple resolution plans. This would result in a maximisation of value to the stakeholders.

- Turnaround Time of Adjudicating Authorities:

One of the pillars for effective implementation of the Code is Adjudicating Authority. The turnaround time of Adjudicating Authority plays a major role in addressing the objective being time bound process.

Delay in Adjudicating Authority processes would directly impact the IBC proceeding in terms of delay in admission of cases, maintaining as a going concern, approval of Resolution Plan and other adjudication aspects. In fact, the Standing Committee on Finance observed that NCLT judicial members shall be at least Hon’ble High Court judges to ensure better judicial & procedural experience & wisdom and the quality of judgement has to be improved.

- Valuation Challenge

Incompleteness in the scope of valuation casts a cloud over the true valuation of the Corporate Debtor. There is an inherent incongruence between Code and Regulation in defining the scope of Liquidation estate and valuation that has resulted in difference of understanding the term assets.

The Code expects IRP/RP to take possession of all the assets both tangible and intangible but the regulation stipulates that valuation be done by physical verification of fixed assets and Inventory of the Corporate Debtor. This has potentially led to a situation wherein the valuers are not willing to value the enterprise but only the assets. The Regulation appears to have lowered the weightage to the Corporate Debtors in Service Sector that has potentially led to sub-optimal valuation. In some cases, elements like Product/Service Quality, brand recall and Distribution capability may have better value than old machinery present. These aspects necessitate a holistic approach of valuation in place to overcome the limitation which includes enterprise valuation.

Need for Innovative Restructuring

The Resolution plan, as envisaged by law, envisages restructuring of Corporate Debtor by way of Merger, Acquisition or Demerger or for that matter does not restrict the scope of the resolution plan except that it should be in conformance of the laws of the land. The process for the same is set out in Section 230 to 232 of the Companies, Act 2013. Unfortunately, adequate weightage have not seen to be given on Innovative restructuring using combination of mergers, acquisitions and demerger facility involving multiple stakeholders considering the feasibility of outcome or future benefits that would accrue. Even the original restructuring, by the Reserve Bank of India, envisaged the Right to Recompense but that does not appear to be relevant in the current thought process. While it would be inappropriate for a new resolution applicant to pay for past poor the assets created from funding or creditor forbearance cannot be lost sight of.

Innovative Restructuring is possible when both the ability of Resolution Applicant to identify opportunity in such restructuring and Co-operation of multiple stakeholders is present with the assistance of professionals.

Role of Asset Reconstruction Companies (ARCs)

The ARCs being registered under the RBI and regulated under the SARFAESI Act have been taking over the stressed debts from Financial Institutions for the purposes of realisation. IBC entitles the financial institutions, either Banks or ARCs, to take action against default debtor in a time bound process. Having initiated action against the assigned stressed debts, the ARC have been prohibited by RBI from being a resolution applicant under the IBC. The ARC has thus been reduced to the role of asset realisation rather than potential agency to facilitate turnaround. RBI has recently formed a committee to examine the Roles of ARCs in the stressed debt Resolution segment and hopefully this issue will get addressed as the ARC can become a huge opportunity to consolidate stressed assets and examine opportunities for a resolution.

Carry Forward Income Tax losses in IBC

In terms of Section 79 of the Income Tax Act, 1961, in case of change in shareholding of a company where public are not substantially interested the carried forward losses cannot be set off against the income or carried forward to subsequent years. To promote the revival of the Corporate Debtors, an amendment was made creating an exception to a company where a change in the shareholding takes place in a previous year pursuant to a resolution plan approved under the IBC, 2016.

This contributes a value addition to the Resolution Applicants by way of setting off the carried forward losses against the future profits to be earned or even creating opportunities for merger with profitable ones improving the return on investment. Strategical evaluation and planning would enable the Resolution Applicant to earn tax-free income as a bonus to revive the stressed units. At the time of determining the resolution amounts rather than valuing the tangible assets, the Resolution Applicants should factor in the benefit of carry forward of loss to be benefited in the future.

It is relevant to note that the tax benefits will be permitted during the liquidation including the submission of Compromise or Arrangement under Section 230 of the Companies Act, 2013. This would imply that there is a potential opportunity for clean slate opportunity through the medium of resolution plans.

Conclusion

The revival through Resolution Plan needs to be the core objective by taking efforts on creating awareness among prospective applicants to acquire potential businesses especially small and mid-size cases, speeding up the approval processes during the CIRP, removal of benchmarking the liquidation value, focusing on the price discovery mechanism for the company and not only for the tangible assets would boost the revival of stressed units at a higher rate. The Resolution Plan provides multiple add on benefits such as tax benefits, transfer of ownership, transfer of licenses etc through an order of the Adjudicating Authority.

Having said that, it will be incumbent upon the Resolution Applicant to evaluate strategically availing the benefits by examining the business structure, exposure, plan and requirements on a case-to-case basis.

It has been only 4 years since initiation of the code. Based on the track record, it is hard to conclude that aims of the code to resolve the troubles of the stressed businesses by moving them into a Corporate Insolvency Resolution Process, transferring them as going concern and to protect the interest of lenders has been fully achieved. Further, Last year had added more challenge to the Board, Lenders, Stressed Corporate Debtors and Resolution Professional in finding resolution. However, consistent amendments to the Code & Regulations, judicial pronouncements, finding of ways to increase the capacity of Court in handling cases and recent introduction of Prepacked Insolvency and Resolution process has brought hope to lenders and Corporate Debtors in distress. In view of the above, resolving insolvency in the country need to see more improvement in future.

Author

- Gopinath P (Membership No. 246645)

(Leading IBC team for the past 4+ years)

Partner

R V K S and Associates,

Chartered Accountants

0 Comments